Equipment financing is a financial arrangement that allows businesses to acquire the necessary equipment or machinery they need for their operations without having to make a large upfront payment.

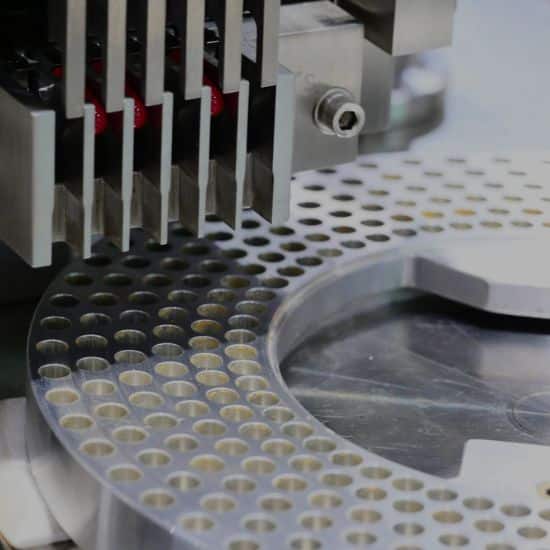

The purpose of business equipment financing is to help businesses acquire the equipment they need to operate or expand their operations. It includes various types of equipment, such as machinery, vehicles, technology hardware, medical equipment, construction equipment, and more.

When you apply for business equipment finance, the lender evaluates the equipment you intend to purchase. Factors considered include the equipment's value, condition, useful life, and resale potential. This assessment helps determine the maximum loan amount.

Lenders consider factors like the creditworthiness of the business, its financial stability, and the equipment's value. Collateral, such as a lien on the equipment, may be required to secure the loan.

After determining the equipment value, the lender offers a loan amount based on a percentage of the equipment's appraised value. Both parties agree on the loan terms, including interest rates, repayment period, and any associated fees.

The business equipment itself is used as collateral to secure the loan. If the borrower defaults, the lender can seize and sell the equipment to recover the outstanding debt.

Equipment financing may offer tax advantages depending on the jurisdiction. Lease payments might be tax-deductible as operating expenses.

Lenders may require periodic updates on the equipment's condition and usage. This ensures that the equipment remains in good working order and retains its value, reducing the lender's risk.

After finalizing the loan agreement, the lender disburses the funds. The borrower uses these funds to purchase the specified equipment, which should be integrated into the business operations promptly.

The borrower must repay the loan according to the agreed terms. This typically involves regular payments, including principal and interest, over the loan's duration. Proper management of loan repayments helps maintain a good credit profile and ensures financial stability.

Maintaining the equipment in good working condition is crucial. Regular maintenance schedules ensure the equipment's longevity and efficiency. The borrower should also periodically evaluate the equipment's performance to ensure it meets business needs and delivers the expected return on investment.

By financing equipment rather than purchasing it outright, businesses can preserve their capital and allocate it to other areas of their operations, such as marketing, inventory, or hiring additional staff.

Equipment financing enables businesses to spread the cost of equipment over time through regular payments, which helps manage cash flow more effectively.

Equipment financing offers flexibility in terms of payment structures, lease terms and end-of-term options. Businesses can often tailor financing arrangements to their specific needs and financial capabilities.

As technology and equipment are rapidly developing, financing allows businesses to keep up to date with the latest advancements without the burden of large upfront costs.